You Asked, We Listened. Here Are The 2024 Payroll Improvements This Year.

12-02-2024 09:16 AM

Your business is always growing and evolving, and so is Toast Payroll. That’s why we’re continuously building the new features you’ve asked for to help you thrive.

Here are our latest updates to power your growth!

Save more time with streamlined management

Refreshed New Hire Flow

- We revamped our new hire workflow so you can guide new team members step-by-step through their hiring paperwork. They get on the floor faster, and you get all the info you need come tax time. Additional useful updates include:

- You can now hire new employees using a mobile device

- Add multiple jobs/pay groups to an employee's profile during onboarding.

- And more!

You can learn more about all of our New Hire Flow here, and check out this video that shows you how to add new Employees.

Improved Time Entry Manager

- Our timesheet management page has gotten smarter and more intuitive — the new page gives you quick access to edit clock-in times, clock-out times, and declared tips. What's more, you can check an employee's scheduled hours against their actual hours worked if you use a scheduling integration, such as Sling by Toast.

Improved Pay Change Experience

- We’ve made it easier to change employee pay rates in the event you want to give someone a raise or local minimum wage regulations change. (Learn how to change employee pay here).

New Payroll Tax Center - your one-stop hub for tax filing information

- Verifying your payroll data in preparation for quarterly filings just got easier with the Payroll Tax Center. Before this release, state tax account numbers, employee SSNs, and state and federal tax rates lived in different places in Toast Payroll. Now you can navigate to one central hub where you can track prior payroll tax filings and prepare for upcoming payroll tax filings by viewing and resolving tasks to help enable success.

The Tax Center is available to HR+ users once you have posted your first payroll. You can:

- View and maintain tax information (e.g. state tax accounts, tax forms) for the business

- Proactively respond to and resolve tax issues

- Keep track of your tax filing timeline

- View critical tax filing data (e.g. rejections, quarterly tax packages, year-end tax documents)

Visit the Tax Center Here or Learn More About the Tax Center Here.

NEW! Capture missing employee SSNs on POS

- You can now configure POS to prompt employees who forget to submit their SSN to do so, right during clock-in, so you have all the information you need come tax time. (Learn how to configure here).

Payroll Customer Support On-the-Go via Live Chat

- Get your questions answered about the payroll product in minutes. Connect with a live agent anytime, anywhere. Start a conversation on Toast Web, Payroll Web, or your mobile app, and easily pick up where you left off whenever you're ready - so you’re never feeling tied to your desk when you need answers.

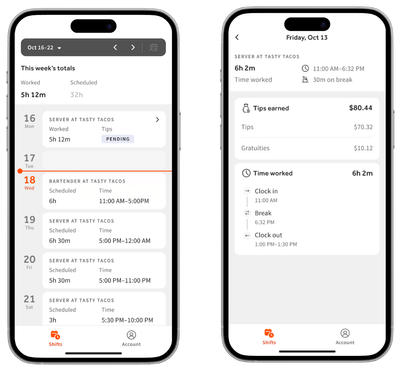

MyToast App

- Employees can self-serve more in MyToast, Toast’s employee app, giving them more visibility and saving you time in answering one-off questions. Employees can visit the Shifts tab to review their hours worked, pay, and tip history (and in 2025, they’ll be able to view W2s come tax time!).

And More Coming Early 2025!

Benefits with SimplyInsured

- Choose health insurance plans that are right for your business and your employees, facilitate open enrollment, streamline deductions, and remit payments all in Toast Payroll

Consolidated login

- Payroll and Sling Customers will be able to enjoy one username & password for ToastWeb, Payroll, Sling, & MyToast

Know someone who needs a new payroll provider? Fill out this form with their information and for every business you refer between 10/15/25-12/31/24 that goes live on Payroll, we’ll give you $500.

* Individual results may vary.

- Labels:

-

Payroll